What van buyers want and how retailers can deliver

The van market is changing, and success today takes more than a well-stocked forecourt. Autotrader’s latest data reveals clear trends shaping van buyer behaviour, stock performance, and the EV future. Here’s what’s happening right now, and how you can use that insight to drive results.

Uneven van demand

Our data shows demand in the van market isn’t as consistent as it once was. In Q1 2025, used van buyer activity on Autotrader grew by 25% year-on-year, with franchise retailers seeing a 27% rise and independents 24%. However, that demand isn’t evenly spread across van types or age bands.

Demand for vans aged 5–10 rose by 12%, remainded stable for 3–5-year-olds (0%) and was up just 2% for 1–3-year-old stock. New van registration data also shows some sharp contrasts — pickups, for example, surged by +60%, while other types, like small vans, fell by -24%.

Despite some inconsitency, buyers remain motivated. There were 11 million site visits to Autotrader’s van platform in Q1, and we found that 95% of van buyers visited a dealership during their purchase journey.

Capture demand where it’s strongest

Buyers haven’t disappeared, demand is just more targeted to different cohorts. The retailers who win will be those who:

Use data to guide their retailing decisions, such as using Retail Check to help with making sourcing and pricing decisions.

Make use of tools like Co-Driver to create engaging and accurate adverts that capture the attention of van buyers with the help of Autotrader Intelligence.

Offer flexibility through Deal Builder, where buyers can reserve online, get part-ex quotes, apply for finance, and arrange collection or delivery.

It’s also worth remembering what influences buyer choice. According to our Van Buyers Research, 80% of buyers say dealer reviews are one of the most important factors in deciding who to buy from, more than distance or recommendation. A strong online presence isn’t optional anymore.

Van stock is up – but so are missed margin opportunities

The number of used vans on Autotrader rose by 23% in Q1 2025 vs the previous year. We project that the UK van parc will rise to 5 million by 2027. As more ex-fleet and older stock returns to market, availability is improving – but it’s also putting pressure on prices and margins. In fact, the average retail price of a used van fell by £1,800 year-on-year in April.

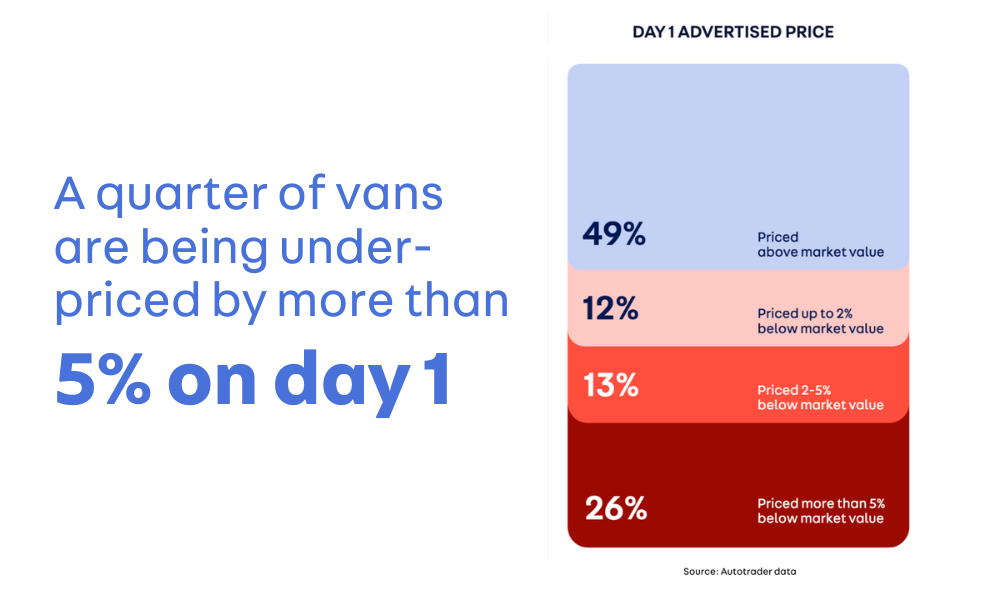

However, there is still a pricing opportunity for retailers. Right now on Autotrader, over 1 in 4 vans are advertised at more than 5% below market value, from day one. This underpricing cost the market an estimated £15 million in missed profit in Q1 alone, particularly on vans with strong Retail Ratings.

By pricing highly Retail Rated stock strongly from day one, retailers can capitalise on strong demand to maximise their margins, without necessarily having to compromise on speed of sale.

Make every van count with data-driven pricing

To protect the margin in a more competitive market:

Take a retail-back approach – price to sell in today’s market, not last month’s.

Use Autotrader’s trade and part-exchange valuations for vans to set the right price and avoid undervaluing high-demand vans.

Retail Check your in-stock vehicles to ensure your vehicles are priced to market, pricing them strongly where demand is robust.

The fastest-selling vans still move in just 15 days. The key is knowing what’s hot, what’s not, and adjusting in real time.

“We use valuations to guide every purchasing and advertising decision... There’s no guesswork anymore – we go with the data.”

EV demand is warming up

Electric van adoption remains slow, making up a small share of van leads and sales. That said, momentum is quietly building, and retailers who prepare now will be ready to lead when the shift accelerates.

Right now, only 27% of van buyers consider an EV, rising to 34% among VAT-registered business buyers. The top reasons buyers said they were considering EVs included lower running costs (39%), home charging (39%), and access to the latest technology (34%).

Barriers remain – price, charging infrastructure, and product choice were all flagged – and EVs are still slower to sell. However, new investment from emerging van brands and the ongoing push from legislation like the ZEV mandate mean this market is set to expand.

Start building your electric advantage now

Don’t wait for demand to explode. Start building your EV capability now:

Make EV adverts accessible and informative – focus on charging times, range, and running costs.

Use Co-Driver to add the right highlights and details that buyers care about.

Be ready to explain the benefits clearly and answer common concerns. Our 'Retailing Electric Vehicles' Masterclass will equip you with all the latest insights.

Van buyers will need education and reassurance, and the retailers who provide that first will build trust early on the Road to 2030.

The van market in 2025 is full of moving parts – but also full of opportunity. Buyer demand is still strong, supply is back, and the EV future is on the horizon. The retailers who respond with smart tools, up-to-date pricing, and a digital-first mindset will be the ones who lead the way.